kansas manufacturing sales tax exemption form

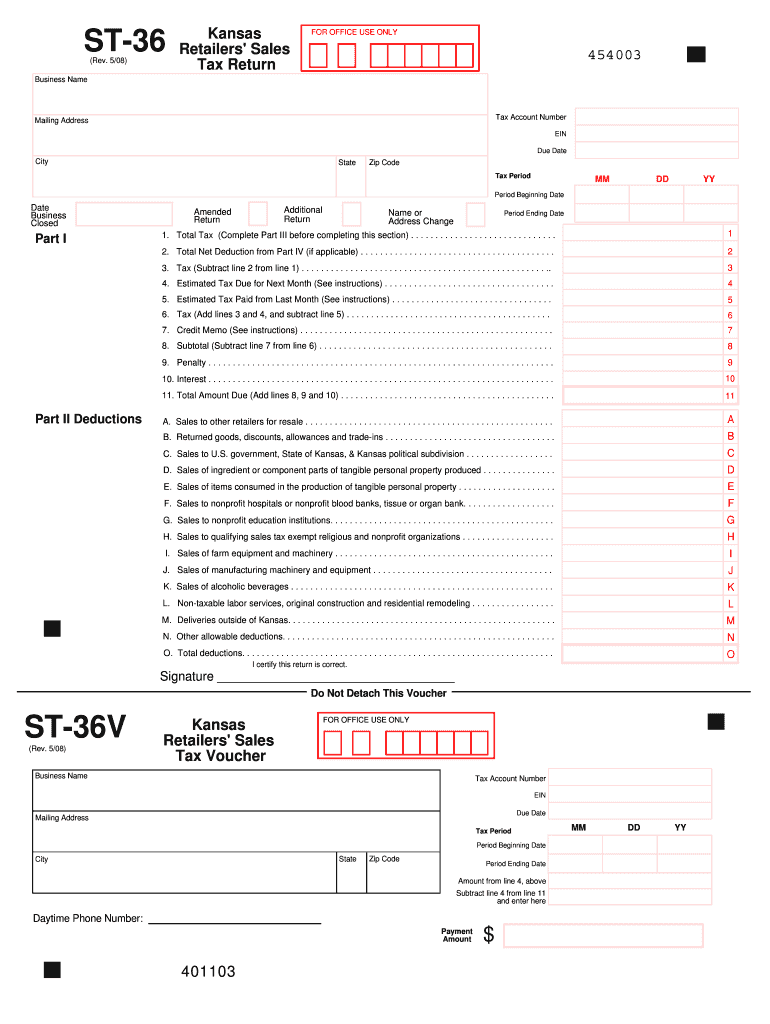

While the Kansas sales tax of 65 applies to most transactions there are certain items that may be exempt from taxation. Attach the Application for Sales Tax Exemption by Motion Picture or Television Production Companies Form 13-88 in this packet Page C.

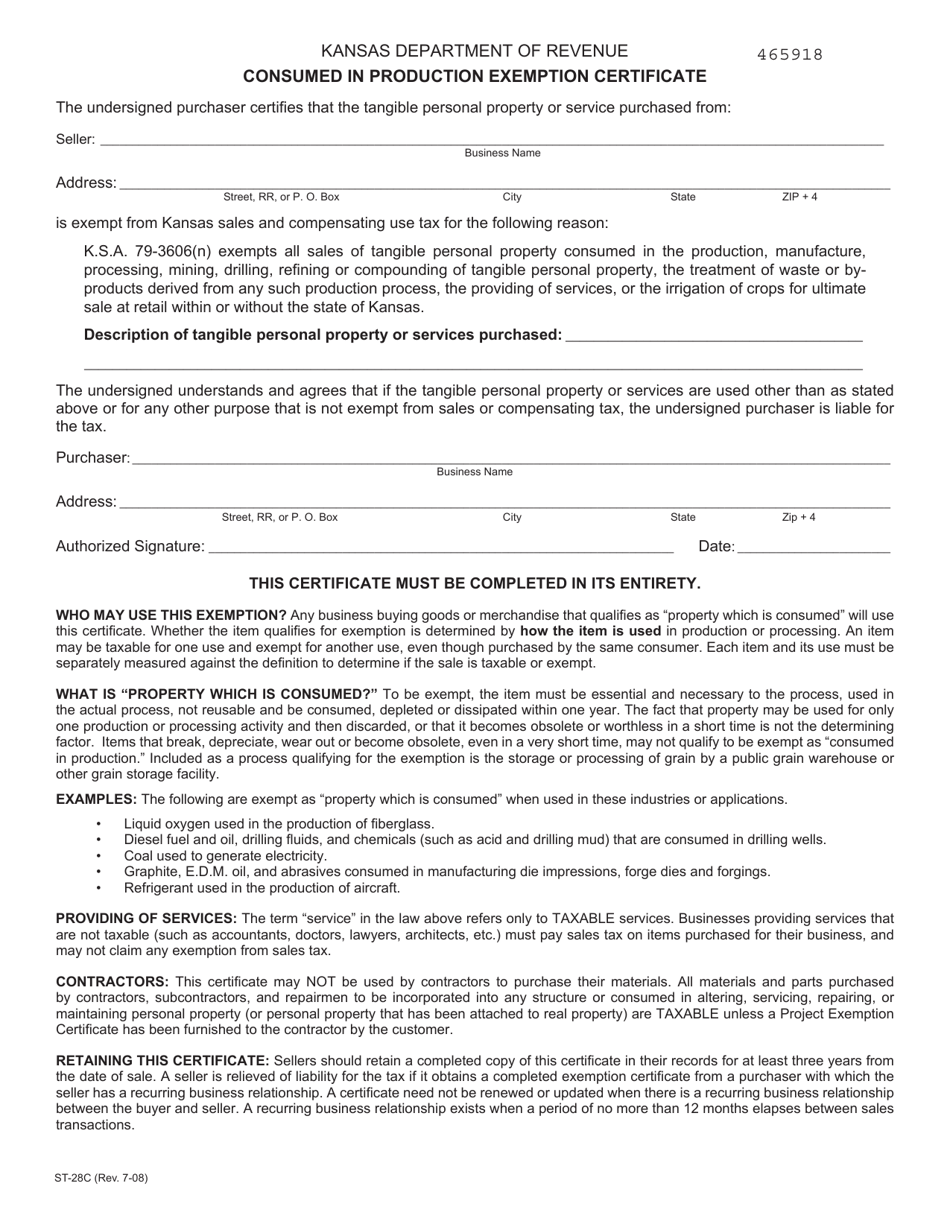

Form St 28c Download Fillable Pdf Or Fill Online Consumed In Production Exemption Certificate Kansas Templateroller

Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory.

. The buyer must have either a Kansas sales tax number. Sales income tax is not really suitable to no-income. Streamlined Sales and Use Tax Certificate of Exemption Form.

ST-28B Sales Tax Exemption on Electricty Gas or Water Rev. Buyers from other states that are not. All questions regarding sales tax are to be referred to the Division of Financial Services General Accounting 785 532-1838 regarding sales tax reporting and exemption.

This page discusses various sales tax exemptions in Kansas. The certificates will need. 79-3606fff exempts all sales of material handling equipment racking systems and other related.

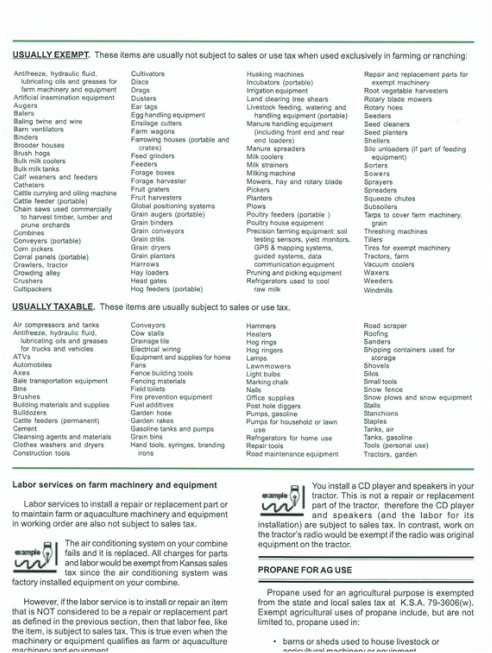

How to use sales tax exemption certificates in Kansas. Utility Sales Tax Exemption. Barbed wire T-posts concrete mix post caps T-post clips screw hooks nails staples gates electric fence posts electric insulators and electric fence chargers.

ST-28B Sales Tax Exemption on Electricty Gas or Water Rev. The sale of machinery and equipment including repair and replacement parts and accessories which is used in Kansas as an integral or essential part of. Sales Tax Entity Exemption Certificate Renewal On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire.

The sale of machinery and equipment including repair and replacement parts and accessories which is used in Kansas as an integral or essential part of an integrated production operation. Are exempt from Kansas sales and compensating use tax for the following reason. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

Whenever an employee engages in outdoors sales process this kind is important. For corporations whose business income is solely within state boundaries the tax is 4 of net income. Form 01-339 back Texas Sales and Use Tax Exemption Certificate PDF Publications.

The sale of machinery and equipment including repair and replacement parts and accessories which is used in Kansas as an integral or essential part of an integrated production operation. Purchasers Affidavit of Export Form. 94-116 Real Property Repair and Remodeling 94-104 Film Video and Audio.

In addition net income in excess of 50000 is subject to a 3. A Kansas Manufacturers or Processors Sales Tax Exemption Certificate Number. Kansas Sale Tax Exemption Form.

Kansas Department of Revenue Home Page.

Kansas Tax Exempt Not For Profit Organizations Attorneys Law Firm

State Resources For Manufacturing Sales Tax Exemptions

Kansas Department Of Revenue Tax Policy Manufacturer Processor Exemption Number

Kansas Department Of Revenue Tax Policy Manufacturer Processor Exemption Number

A Complete Guide To Sales Tax Exemptions And Exemption Certificate Management

States Served National Utility Solutions Predominant Use Study Experts

Kansas Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Sales Tax Exemption Fencing Natural Disasters Wichita Cpa

Kansas Department Of Revenue Tax Policy Manufacturer Processor Exemption Number

Form St 21 Fillable Sales And Use Tax Refund Application

Form St 201 Download Fillable Pdf Or Fill Online Integrated Production Machinery And Equipment Exemption Certificate Kansas Templateroller

Kansas Sales Tax Basics For Bars And Restaurants Sales Tax Helper

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

Is My Purchase Taxable Stillwell Sales Llc

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

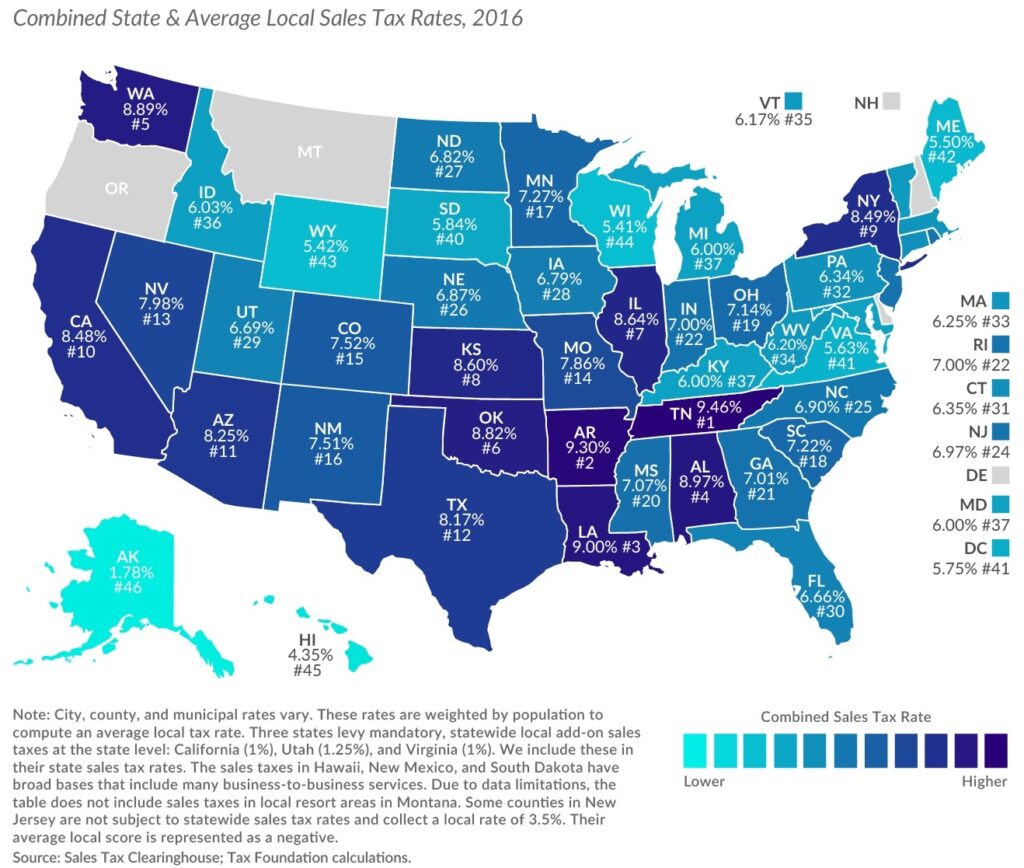

Sales Taxes In The United States Wikipedia

Four Tips And Tricks To Qualify For Manufacturing Sales Tax Exemptions

Kansas Clarifies Sales Tax Responsibilities For Remote Retailers And Marketplaces