child tax credit november 15

You have until Tuesday Nov. The deadline to sign up is November 15 2021.

Child Tax Credit Update Eyewitness News

Have until November 15 to.

. Ad Get Help maximize your income tax credit so you keep more of your hard earned money. Increased to 3600 from 1400 thanks to the American Rescue Plan. 2 days agoThe deadline for Floridians to apply for the Advanced Child Tax Credit is Tuesday November 15.

November 15 2021 442 PM CBS Chicago. Those who do not sign up. However many eligible parents and other caretakers who do not routinely file federal income tax returns are not receiving the monthly credit payments.

Those who do not. Households on low incomes can still claim advance payments until November 15 with another tool which launched in September. For those who claimed early the IRS has.

Free File to stay open until Nov. Families who sign up will normally. Have been a US.

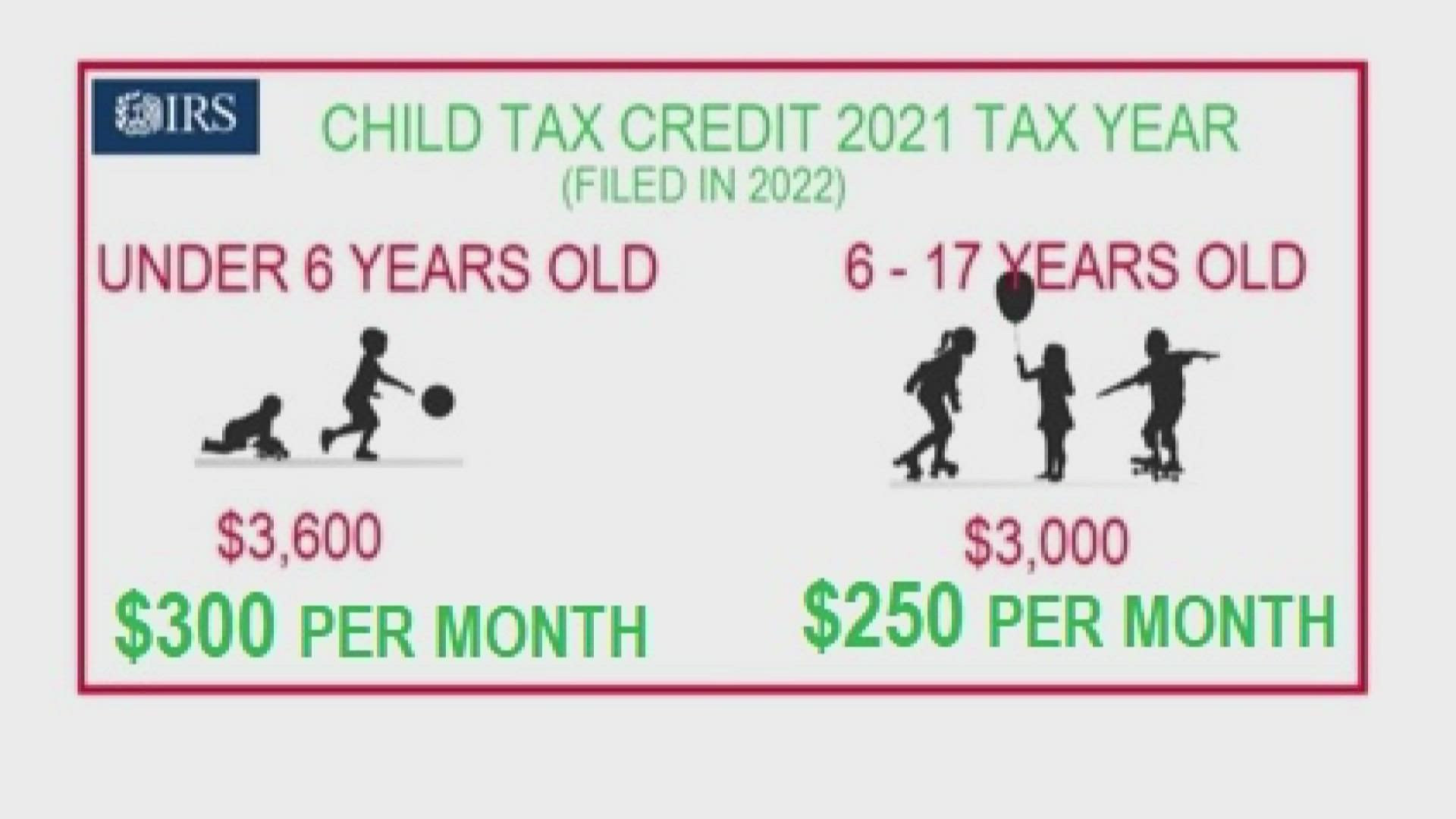

The American Rescue Plan passed in March expanded the existing child tax credit adding advance monthly payments and increasing the benefit to 3000 from 2000 with a. Ad Parents E-File to Get the Credits Deductions You Deserve. Free File allows people with incomes of 73000 or less to file a return online for free through third-party.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. 15 and file a simplified tax return to get the full credit. Get the most out of your income tax refund.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The deadline to sign up for monthly Child Tax Credit payments this year was November 15.

Part of the American Rescue Plan the benefit is situated to. Enhanced child tax credit. F amilies eligible for their enhanced child tax credit CTC have until November 15 to sign up and receive half of their total CTC for this calendar year.

MIAMI October 14 2022. The American Rescue Plan signed into law by President Biden on March 11 2021 increases the Child Tax Credit CTC to provide up to 300 per month per child under age 6. The letter printed in English and Spanish outlines eligibility requirements for the child tax credit the earned income tax credit and others.

E-File Your Tax Return Online. 15 is also the date. Individuals whose incomes are below 12500 and couples below 25000 may be able to file a simple tax return in as little as 15 minutes the IRS said on the website.

CASH-STRAPPED American families are set to receive their latest child tax credit payment today - November 15. With advanced payments stopping at the end of the year the November 15 deadlines is the last opportunity for families to sign up on the. QUEENS NY US.

The full child tax credit benefit is eligible for incomes up to 75000 for individuals 112500 for heads of household and 150000 for married couples. 15 to complete a. The Child Tax Credit benefits for those eligible are 3000 per child between.

Most families who have. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Total Child Tax Credit.

It noted that it will keep its Free File program open through November 17. November Child Tax Credit deadline. Grace Meng D-Queens and Assemblywoman Nily Rozic D-Fresh Meadows announced today that November 15 is the last day for families to seek the.

People can get these benefits even if they dont work and even if they receive no income. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving.

The deadline to apply for the Advanced Child Tax Credit is Tuesday November 15th. The American Rescue Plan expanded the Child Tax Credit to provide working families with advance monthly payments of 250 300 per child. CBS Baltimore -- The Internal Revenue Service IRS sent out the fifth round advance Child Tax Credit payments on.

17 to help refund filers eligible for stimulus Child Tax Credit EITC Starting this week the Internal Revenue Service is sending letters to more than. Parents can check the IRS Child Tax Credit Portal for updates.

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit A Lifesaver For Families Barely Staying Afloat

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Next Payment Coming On November 15 Marca

Claim Your Child Tax Credit Getctc

Rep Sara Innamorato The Deadline To Sign Up For The 2021 Child Tax Credit Is Quickly Approaching Families Have Until Monday November 15th To Sign Up If They Re Not Automatically Receiving

Claim Your 2021 Child Tax Credit By November 15 The Morning Bell

Irs Investigating Why Some Families Didn T Receive September Child Tax Credit

Parents Still Have Time To Claim Child Tax Credit Of Up To 3 600

Child Tax Credit Schedule 8812 H R Block

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit Why You May Need To Opt Out Of 300 Payments By The November Deadline The Us Sun

Child Tax Credit Payments Go Out To Tens Of Millions Of Families Abc17news

Child Tax Credit 2021 Irs Payments Hit Bank Accounts As Parents Await Stimulus Fingerlakes1 Com

Recovery Package Should Permanently Include Families With Low Incomes In Full Child Tax Credit Center On Budget And Policy Priorities

Nys Tax Department Important Notice Regarding The Child Tax Credit

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Wcnc Com